Bookkeeping

Calculating the Fixed Overhead Expenditure Variance

Specifically, fixed overhead variance is defined as the difference between Standard Cost and fixed overhead allowed for the actual output achieved and the actual fixed overhead cost incurred. Recall that the fixed manufacturing overhead costs (such as the large amount of rent paid at the start of every month) must be assigned to the aprons produced. In other words, each apron must absorb a small portion of the fixed manufacturing overhead costs. At DenimWorks, the fixed manufacturing overhead is assigned to the good output by multiplying the standard rate by the standard hours of direct labor in each apron. Hopefully, by the end of the year there will be enough good aprons produced to absorb all of the fixed manufacturing overhead costs. A simple way to assign or allocate the fixed costs is to base it on things such as direct labor hours, machine hours, or pounds of direct material.

Managerial Accounting

However, the company ABC has the normal capacity of 1,000 units of production for August as they are scheduled to produce in the budget plan. The variance is unfavorable because the actual spending was higher than the budget. Hence, any significant increase or decrease in fixed cost is a critical point for an entity and shall be dealt with immediately since an unexpected material expense would hurt the company’s financial statements. They do not vary as the output varies unless a specific point is crossed and it becomes stepped costs instead of fixed costs.

(ii) Volume Variance

- At the start of a period XYZ Limited estimates that they will incur £30,000 of fixed overheads.By the end of the period they had actually spent £28,000 on fixed overheads.

- If the actual production volume is not the same as the budgeted production volume then there will be a variance between the budgeted fixed overhead and the standard fixed overhead.

- If the fixed overhead cost applied to the actual production using the standard fixed overhead rate is bigger than the budgeted fixed overhead cost, the fixed overhead volume variance is the favorable one.

- For example, a non-cash item such as depreciation calculations depend on the costing method adopted by the management.

- The fixed overhead spending variance is the difference between the actual fixed overhead expense incurred and the budgeted fixed overhead expense.

Another variable overhead variance to consider is the variable overhead efficiency variance. As a result, the company has an unfavorable fixed overhead variance of $950 in August. This is due to the actual production volume that it has produced in August is 50 units lower than the budgeted one. Standard fixed overhead applied to actual production is the fixed overhead cost that is applied to the actual production volume using the standard fixed overhead rate. The budgeted production volume here is also referred to as the normal capacity of the company or the existing facility in the production. Likewise, if the actual production exceeds the normal capacity, the result is favorable fixed overhead volume variance and vice versa.

How do we calculate the total overhead cost variance?

This means that they must have had an unexpected earning of $80,000 positively affecting the financial statements. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Create a Free Account and Ask Any Financial Question

An overhead cost variance is the difference between how much overhead was applied to the production process and how much actual overhead costs were incurred during the period. Therefore, these variances reflect the difference between the standard cost of overheads allowed for the actual output achieved and the actual overhead cost incurred. Figure 10.14 summarizes the similarities and differences betweenvariable and fixed overhead variances. Notice that the efficiencyvariance is not applicable to the fixed overhead varianceanalysis.

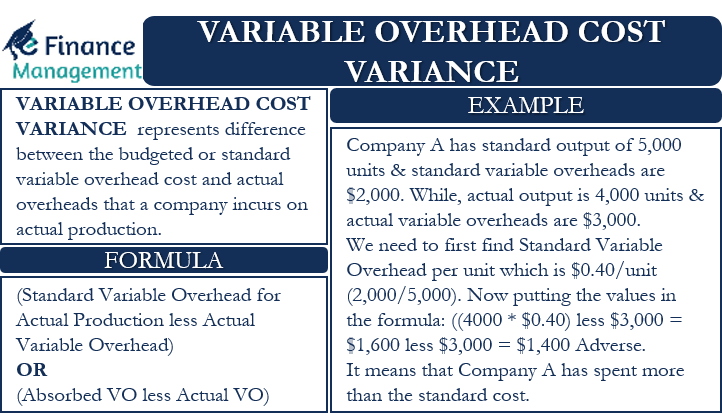

What is a variable overhead variance?

By contrast, efficiency variance measures efficiency in the use of the factory (e.g., machine hours employed in costing overheads to the products). Fixed overhead costs are expenses that do not vary with changes in production or sales volume, such as rent, insurance, property taxes, and depreciation. In our example, we budgeted the annual fixed manufacturing overhead at $8,400 (monthly rents of $700 x 12 months).

Because fixed overhead costs are not typically driven byactivity, Jerry’s cannot attribute any part of this variance to theefficient (or inefficient) use of labor. Instead, Jerry’s mustreview the detail of actual and budgeted costs to determine why thefavorable variance occurred. For example, factory rent, supervisorsalaries, or factory insurance may have been lower thananticipated. Further investigation of detailed the fixed overhead spending variance is calculated as: costs is necessaryto determine the exact cause of the fixed overhead spendingvariance. The total variable overhead cost variance is also found by combining the variable overhead rate variance and the variable overhead efficiency variance. By showing the total variable overhead cost variance as the sum of the two components, management can better analyze the two variances and enhance decision-making.

Fixed overhead spending variance, also known as fixed overhead expenditure variance, measures the difference between actual fixed costs incurred and the budgeted fixed costs. Unlike other operating variances such as variable overhead efficiency variances, we typically assume the fixed overheads to remain unchanged. Changes in fixed overheads require approvals from top management, so they become top level management responsibility.

Fixed overhead variances are particularly important when it comes to variance analysis. A variance analysis compares all the budgeted figures with the actual figures and analyzes the reasons behind such differences. It is one of the two parts of fixed overhead total variance; the other is fixed overhead volume variance. Business expansion often creates fixed overheads expenditure variances (also other variances change), that would need adequate justification before approval from top management. As with any variance control, such analysis will provide valuable information, if the actual reasons for deviation are analyzed. Under normal circumstances, factory fixed overheads such as Electricity, Insurance, Indirect labor, and material should remain fixed.