Forex Trading

Is algo trading profitable in India

They have a platform called “Streak” which is a cloud-based algorithmic trading platform that allows traders to build, backtest, and deploy algorithmic trading strategies. Depending on your goals, you can use your strategy or the software’s offered strategies. Meanwhile, You can incorporate multiple strategies while trading, which can be paused or changed per the trader’s needs. Here we have created a list of some of the best algorithmic trading software in India with their pros and cons so that you can take your investment journey one step ahead. It’s also worth noting that while algo trading can be profitable, it’s not a guarantee of success. Market conditions can change quickly, and past results aren’t necessarily indicative of future results.

This resulted in a massive “flash” crash, where algorithms lost their footing, earning the spoofing trader around $40 million. If a few investors ran portfolio insurance through algorithms, it might have worked well. But when nearly everyone is using them, they become a self-fulfilling prophecy. In India, algorithmic trading is still less than 50%, and firms are relatively small in size.

Tradestation:

Algorithmic trading provides a more systematic approach to active trading than methods based on trader intuition or instinct. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. But the human thinking that technology could save the day was exactly what ruined the day.

Traders who can navigate the challenges and take advantage of the opportunities presented by this technology will be well-positioned to succeed in the years ahead. One of the primary disadvantages of algorithmic trading is the high upfront cost of setting up the necessary technology is algo trading profitable in india and infrastructure. Additionally, ongoing maintenance costs can be significant, as systems require regular updates and maintenance to remain effective. While algorithmic trading offers many advantages, it also has potential drawbacks that traders should be aware of.

Zerodha Algoz:

Algo trading can be profitable, but it depends on various factors such as the effectiveness of the trading strategy, market conditions, risk management, and the quality of the algorithm’s implementation. Using Tradetron’s marketplace gives you access to the best algo trading strategies. The marketplace is built as a tool to categorically rank the best automated trading strategies.

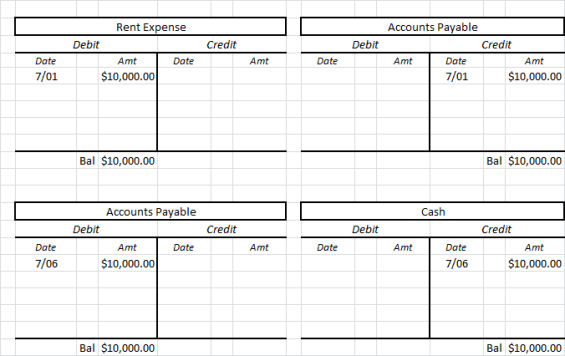

You can buy stocks based in the US from India and can have a trading account with an international broker. In today’s time, most of the leading brokerages along with stock exchanges have the ground for operationalising Direct Market Access (DMA). Brokerages such as Citi, Merrill Lynch, Morgan Stanley, JP Morgan, Goldman Sachs, CLSA and Deutsche Equities have their DMA software to synchronise it with the systems at the stock exchange. Learn algorithmic trading basics and gain a solid foundation in this exciting field. A computer program is designed in a manner that monitors the prices and places the orders when conditions are met. For example, a trader is looking to buy ten stocks of a company when the 30-day moving average for the stock crosses above the 50-day moving average mark.

10 “Best” AI Stock Trading Bots (August 2023) – Unite.AI

10 “Best” AI Stock Trading Bots (August .

Posted: Tue, 01 Aug 2023 07:00:00 GMT [source]

Plus, make sure the broker is regulated by the Securities and Exchange Board of India (SEBI). ODIN allows traders to auto-execute trades based on their selected strategies. Traders can choose from a variety of strategies including spread, trading options, momentum, and execution based.

Trade Tron

Algorithmic trading is the process of using a computer program to follow a defined set of instructions for placing trades to generate profit. This process is executed at a speed and frequency that is beyond human capability. The set of instructions is based on timing, price, quantity and any other mathematical models.

Using 50- and 200-day moving averages is a popular trend-following strategy. As a consequence of technological advancements, our actions rely on technology and, more recently, artificial intelligence. The same is accurate for the stock market, where investors are now assisted with trading decisions by the best algo trading software in India.

- Algorithmic trading is a useful contemporary concept that is being adopted across the globe.

- A very large algorithm-based hedge fund, Rennaisance Technologies, earned the founder Jim Simons $1.6 billion in profits and a place as the highest paid hedge fund manager in 2019.

- Quantiply is fully automated and customizable algo trading software to perform trades in nifty, bank nifty, and futures & options.

- One of the most significant trends in algorithmic trading is using artificial intelligence and machine learning to inform trading decisions.

- To become proficient in algorithmic trading, you need to look at quantitative analysis or quantitative modelling, as it is significantly used in algorithmic trading.

For example, 30-day, 50-day, and 200-day moving average are the most popular trends used. Every strategy for implementing algorithmic trading India requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. Following are some – Mid to long-term investorsBuy-side firms such as pension funds, mutual funds, insurance companies, etc. You have already seen how algorithmic trading is profitable with regard to helping you save time and efforts. Mean Reversion relies heavily on the concept that no matter the lows and highs, the asset price is bound to revert to its mean value or average rate.

Advantages and Disadvantages of Algorithmic Trading

The allure has got so out of hand that Bank of Japan started to print money and buy its own country’s ETFs. The central bank’s market presence is so big that it is now the dominant shareholder in 23 of the top 100 companies. The modus operandi observed is that once a client pays amount to them, huge profits are shown in his account online inducing more investment. However, they stop responding when client demands return of amount invested and profit earned. As an individual, you as a retail trader cannot go to the exchange and ask for approval.

Tradetron is one of the most popular online algo trading platforms that provide several high-end features and allows its users to try and test multiple Algo trading strategies in the stock market. One of the most comforting thing is that you don’t need to write a single code or learn any programming language to start using this algorithmic trading system. Although algorithmic trading has gained popularity in many countries, including India, its profitability depends on a number of variables. Algorithmic trading, also referred to as “algo trading,” is a process for carrying out trades by utilizing software and algorithms.

They analyse companies, sectors, businesses, prices and other data, and decide when to buy or sell. But this data can be automatically analysed by a computer as well, and if you program an algorithm right, you could have the computer place orders automatically, and more importantly, quickly. India allowed algorithmic trading only in 2008, but algos control nearly a third of all trades already.

Trade Smarter, Not Harder: How Tradetron’s Algo Trading … – Passionate In Marketing

Trade Smarter, Not Harder: How Tradetron’s Algo Trading ….

Posted: Sat, 20 May 2023 07:00:00 GMT [source]

Another option is to visit a news website that compiles market data from many exchanges and provides it to end users uniformly. Algo trading also helps retail investors to overcome human interventions and the effect of their feelings on their trades. By doing so, there are fewer chances of the retail investors making wrong trading decisions due to greed, fear or plain lack of experience. The institutional investors also have access to cutting-edge technology and they have the human capital that is trained in creating algorithms and codes. Due to this reason, they are able to form effective strategies and work them out.

Also, algorithmic trading offers accuracy when it comes to predicting the trade positions (entry and exit). The last step in algorithmic trading is to put the algorithm into practice using a computer programme after backtesting. This includes testing the algorithm on historical periods of past stock-market performance to determine if it would have been profitable.

This Algo trading software has real trading, paper trading, and backtesting features. It’s also useful for investing in a series of bonds and non-convertible debentures to maximize overall earning potential. Tradition Tech can be the choice; it has launched recently and is gaining popularity because of its features. Whether you want to run technical analysis, fundamental analysis, even based on algo features or any customized terms, it’s the tool that fulfills your needs.

In theory, the transaction can make money faster and more often than a human trader. It is also India’s most sophisticated and well-liked automated trading system. But you should choose the best algo trading software in India that offers real-time market, and business data feeds. These elements should be included directly into the system or easily incorporated from other sources. The essence of the question is algo trading profitable, varies to some extent for the institutional investors and the retail investors. For institutional investors, algo trading turns out to be extensively profitable.

Potential Impact of Artificial Intelligence and Machine Learning on Algorithmic Trading

Following are the technical requirements of algorithmic trading – computer programming – required to program the trading strategy using any language. AlgoTraders is one of the best open source algo trading platforms in India with immense popularity. Its latest version uses an Esper engine that helps it to operate at a very high speed.

- Last, as algorithmic trading often relies on technology and computers, you’ll likely rely on a coding or programming background.

- Technically, there are several mathematical algorithms at play for making trading decisions on the basis of current market data, which then send and execute the order(s) in the financial markets.

- Also, algorithmic trading offers accuracy when it comes to predicting the trade positions (entry and exit).

- Meanwhile, You can incorporate multiple strategies while trading, which can be paused or changed per the trader’s needs.

- However, the challenge is to transform the strategies mentioned above into an integrated computerized process including access to the trading account for placing orders.

Originally, the stock trading tool was designed for proprietary use, but now accessible to everyone who trades in the stock market. It has incredibly fast speed, several customizable options, high scalability, and efficiency, with top-notch security, making it ideal for low-tendency trading activities. Quantiply is only supported by a limited number of brokers, including Zerodha, Upstox, IIFL, 5Paisa, AC Agarwal, and AngleOne. By using automated trading systems, traders can execute trades much faster than possible with manual trading. This allows traders to take advantage of market opportunities quickly and more effectively.